The State of New Chains: Berachain, Abstract, Unichain, Ink, and Worldchain

The blockchain landscape witnessed several high-profile launches in early 2025, each promising unique value propositions. Six months in, the data reveals a sobering picture of post-launch traction.

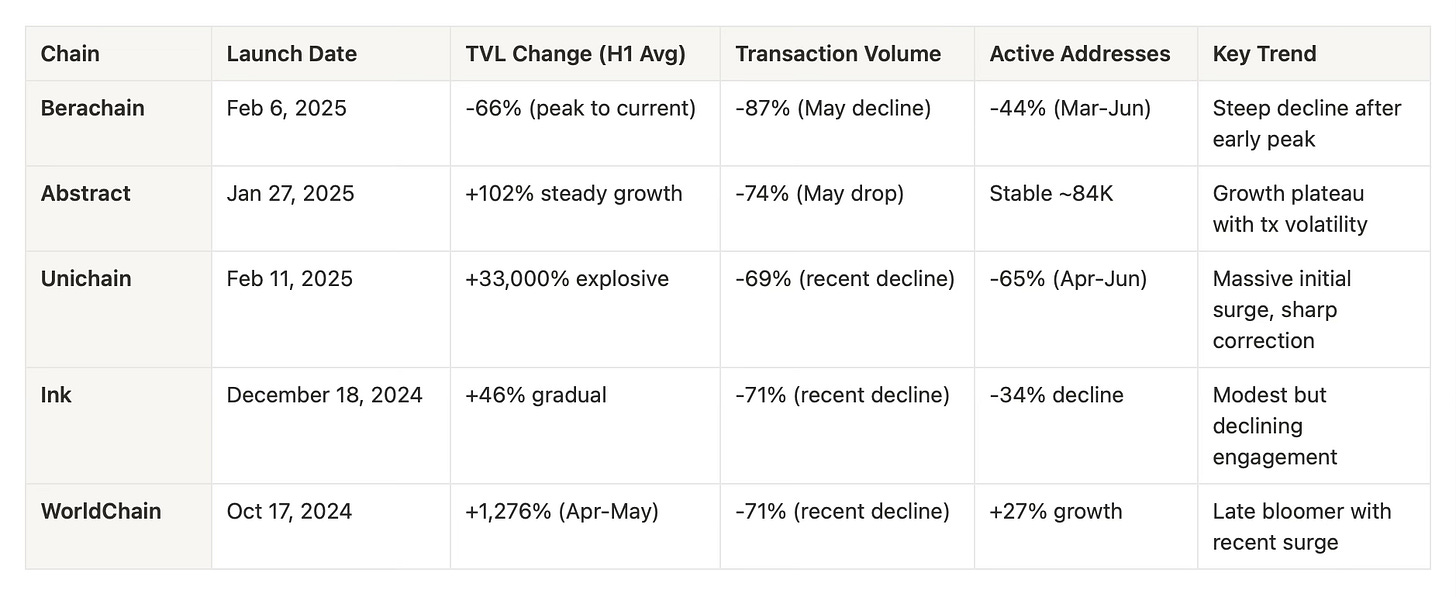

Performance Overview: Monthly Metric Changes

Chain Analysis

Berachain: The Hype Cycle Reality

USP: Proof of Liquidity consensus mechanism aligning network security with liquidity provision Token: BERA live, launched at $6.90, currently $2.45 (-58%)

Berachain attracted $3.1 billion in pre-launch liquidity and reached $3.27 billion TVL within 20 days of mainnet, making it temporarily the 6th largest blockchain by TVL. However, the data shows a classic post-TGE correction pattern. TVL crashed from $3.14B in March to $988M by June (-68%), while transaction volume plummeted 87% in May alone.

Reality: Despite innovative PoL mechanics, Berachain faces the challenge of sustaining incentivized liquidity post-airdrop. The sharp metrics decline suggests dependency on token rewards rather than organic usage.

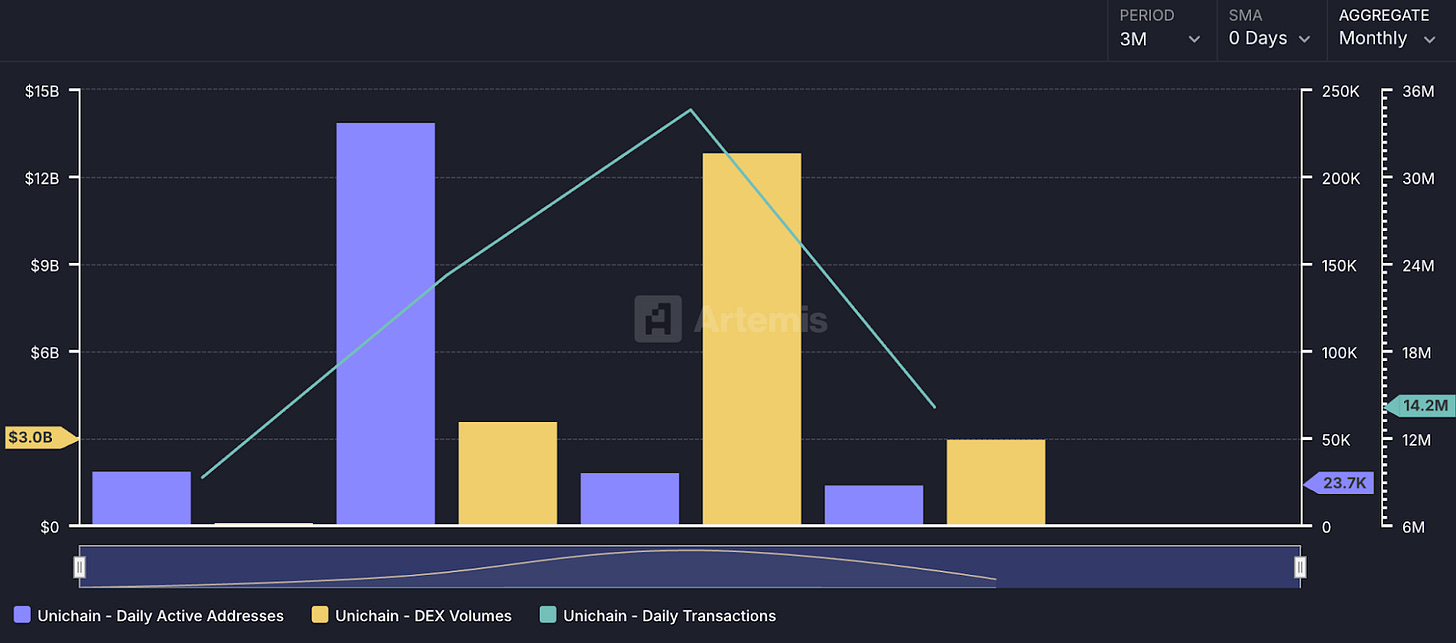

Unichain: DeFi-Native Infrastructure Play

USP: DeFi-optimized L2 with 1-second blocks, 95% lower fees, built by Uniswap team Token: No native token announced

Unichain processed 95 million transactions and deployed 14.7 million smart contracts during testnet, demonstrating strong developer interest. The TVL explosion from $2.28M to $755M represents genuine DeFi migration, particularly visible in DEX volumes reaching $12.86B in April.

Reality: Unichain benefits from Uniswap's ecosystem integration. The recent 69% transaction decline mirrors broader market conditions rather than fundamental issues. Strong DEX activity suggests sticky liquidity.

Abstract: Steady Builder Approach

USP: Consumer-focused blockchain emphasizing user experience and account abstraction Token: Not yet launched

Abstract presents mixed signals with TVL growing from $14M to $28M (+102%) but struggling with user engagement. Despite maintaining 72K active addresses, transaction volume collapsed 74% in May, and fees dropped 70% in the same period. The DEX activity remains minimal, suggesting limited DeFi adoption.

Reality: Abstract's consumer focus hasn't translated to sustained usage patterns. While avoiding token-driven speculation, it also lacks the hooks that drive user retention. The steady TVL growth appears disconnected from actual chain activity, indicating potential wash trading or incentivized deposits rather than organic usage.

Ink: The Quiet Contender

USP: Kraken-backed Layer 2 focused on institutional-grade DeFi and trading infrastructure Token: No native token announced yet

Ink shows modest but concerning metrics with TVL growing 46% to $7.55M over H1 2025, but from a very low base. The chain maintained around 75K active addresses but suffered a 71% transaction decline in recent months. Most telling is the DEX volume pattern - spiking to $144.72M in April before crashing 92% to $11.74M.

Reality: Despite Kraken's backing, Ink struggles to differentiate itself in the crowded L2 space. The low TVL and volatile transaction patterns suggest limited organic adoption. The institutional angle hasn't translated to measurable traction yet.

Worldcoin: The Surprise Performer

USP: Identity-verified blockchain linked to Worldcoin ecosystem

Token: WLD trading at $1.13

WorldChain delivered the strongest late-stage performance with TVL surging 1,276% from March to May ($2.92M to $40.21M). This coincided with broader Worldcoin ecosystem developments and improved token performance.

Reality: WorldChain benefits from World's user verification system, creating unique network effects. The recent growth suggests the identity-blockchain thesis may have merit beyond initial skepticism.

Market Signals and Trends

The Incentive Cliff: Most chains show severe transaction drops in May-June, suggesting the end of launch incentives. Berachain's 87% transaction decline exemplifies this pattern.

TVL vs. Usage Disconnect: High TVL doesn't guarantee sustained activity. Berachain maintained nearly $1B TVL despite collapsing transaction volume, indicating locked or illiquid positions.

DeFi Integration Matters: Unichain's strong DEX volumes ($2.05B current) demonstrate that purpose-built infrastructure can drive real usage when integrated with existing protocols.

Identity Creates Stickiness: WorldChain's late surge suggests identity-verified networks may have different growth dynamics than purely financial blockchains.

H1 2025 Verdict

The new chain launches of 2025 reveal a maturing market where initial hype cycles compress rapidly. Success requires either deep ecosystem integration (Unichain), sustained incentive models beyond airdrops (ongoing challenge for Berachain), or unique value propositions that create network effects (WorldChain's identity verification).

Most chains face the post-mainnet reality: replacing speculative usage with organic demand remains the hardest challenge in blockchain scaling. The 70%+ transaction volume declines across multiple chains in May-June 2025 suggest the market is becoming more discerning about where it deploys capital and attention.

The survivors will be those that solve real problems rather than just promising better performance metrics.