The Best Fundraising Rounds of the Summer

Tracking early-stage investments reveals the breakout protocols and narratives set to dominate 2024 – 2025. Jump in now to be an early adopter and explore the depths of VC funding.

In this publication, I share my personal watchlist of protocols that bring innovation, have influential backers, and show promising uptrend potential. Remember, this is just my opinion.

At the end, you'll find helpful links for your own research.

Morpho Labs | Lending

Funding summary

Total raised: $69.35M

Latest round: Undisclosed, $50M

Backers: Coinbase Ventures, Pantera Capital, Fenbushi Capital, a16z, Ribbit Capital, and more.

Quick blurb

Morpho is arguably the most significant phenomenon in DeFi this year, boasting over $1.5 billion in TVL. As of now, it ranks as the 5th largest lending protocol on DefiLlama.

Morpho is a decentralized, non-custodial lending protocol that enables the creation of immutable and efficient lending markets in a permissionless manner. Think of it as a secure marketplace for lending offerings, active on Ethereum and Base.

Early bird opportunities

To earn the future $MORPHO token, you must participate in the protocol as either a supplier or borrower. The interface lets you input the projected FDV of Morpho to calculate the additional APY you will earn once the token goes live. Consequently, many pairs on Morpho have a positive borrowing APR.

Website | dApp | 𝕏 | Docs | Raise announcement | CryptoRank profile

MegaETH | L2

Funding summary

Total raised: $20M

Latest round: Seed, $20M

Backers: Dragonfly Capital, Vitalik Buterin, Joseph Lubin, Robot Ventures, and more.

Quick blurb

MegaETH claims to be the first "real-time blockchain" with full Ethereum compatibility. In this context, "real-time" means MegaETH processes transactions immediately upon arrival and publishes updates instantaneously.

The concept of MegaETH arose from the limitations of most EVM-compatible blockchains, which typically manage only 3-digit TPS (Transactions Per Second). In contrast, MegaETH aims for 100,000 TPS.

To achieve this real-time performance, MegaETH leverages Ethereum's security, Optimism's fault-proof system, and its own optimized sequencer.

Early bird opportunities

Currently, there are no ongoing campaigns for early participants. However, the project is onboarding developers to build on it, so a testnet launch is likely soon. Stay tuned.

Website | 𝕏 | CryptoRank profile

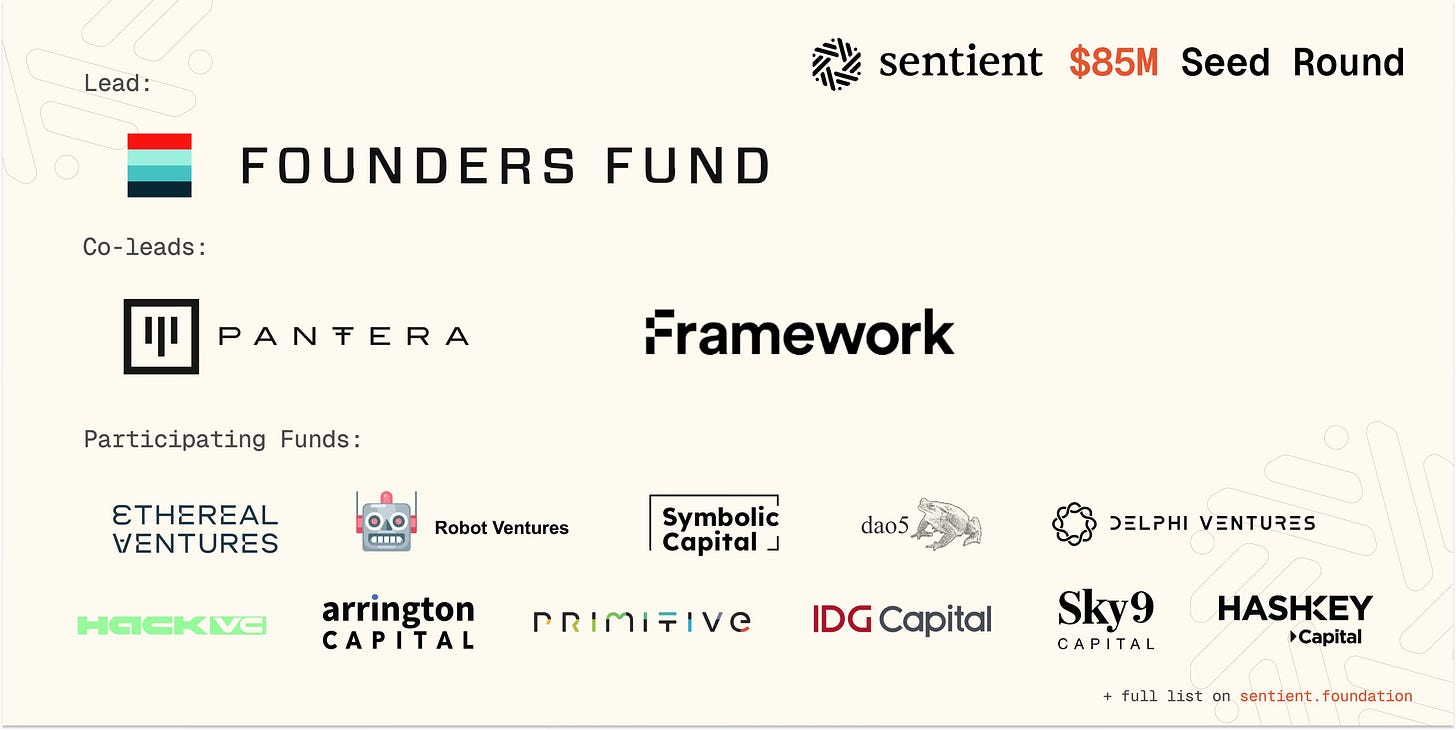

Sentient | AI

Funding summary

Total raised: $85M

Latest round: Seed, $85M

Backers: Founders Fund, Pantera Capital, Framework Ventures, Robot Ventures, Delphi Ventures, and more.

Quick blurb

Sentient is a foundation focused on developing an open artificial general intelligence (AGI) platform.

It offers a blockchain protocol for AI artifact contracts and exchanges, a repository for community-built AI innovations, and incentives for AI developers. The foundation supports AI projects through community contributions, aiming to align AI advancements with collaborative efforts.

Early bird opportunities

The platform is not yet live with a Coming Soon status. However, you can join the Waitlist to be one of the early users to get access to it.

Website | 𝕏 | Raise announcement | CryptoRank profile

Daylight Energy | DePIN

Funding summary

Total raised: $13.2M

Latest round: Series A, $9M

Backers: a16z, Framework Ventures, Digital Currency Group and more.

Quick blurb

Daylight is a DePIN protocol dedicated to energy distribution. It leverages the Base blockchain to integrate energy devices through its app, rewarding users for utilizing green energy.

Daylight offers solar panels, battery storage, heat pumps, and weatherization services from local professionals, currently available in Texas, Pennsylvania, and New Jersey.

Essentially, it connects consumers with green energy suppliers and will incentivize their collaboration once the token goes live.

Early bird opportunities

The Daylight Protocol testnet is live! If the Daylight app is available in your country (unfortunately it isn't in mine), you can connect your distributed energy devices to the app and start earning rewards.

Website | App | 𝕏 | Raise announcement | CryptoRank profile

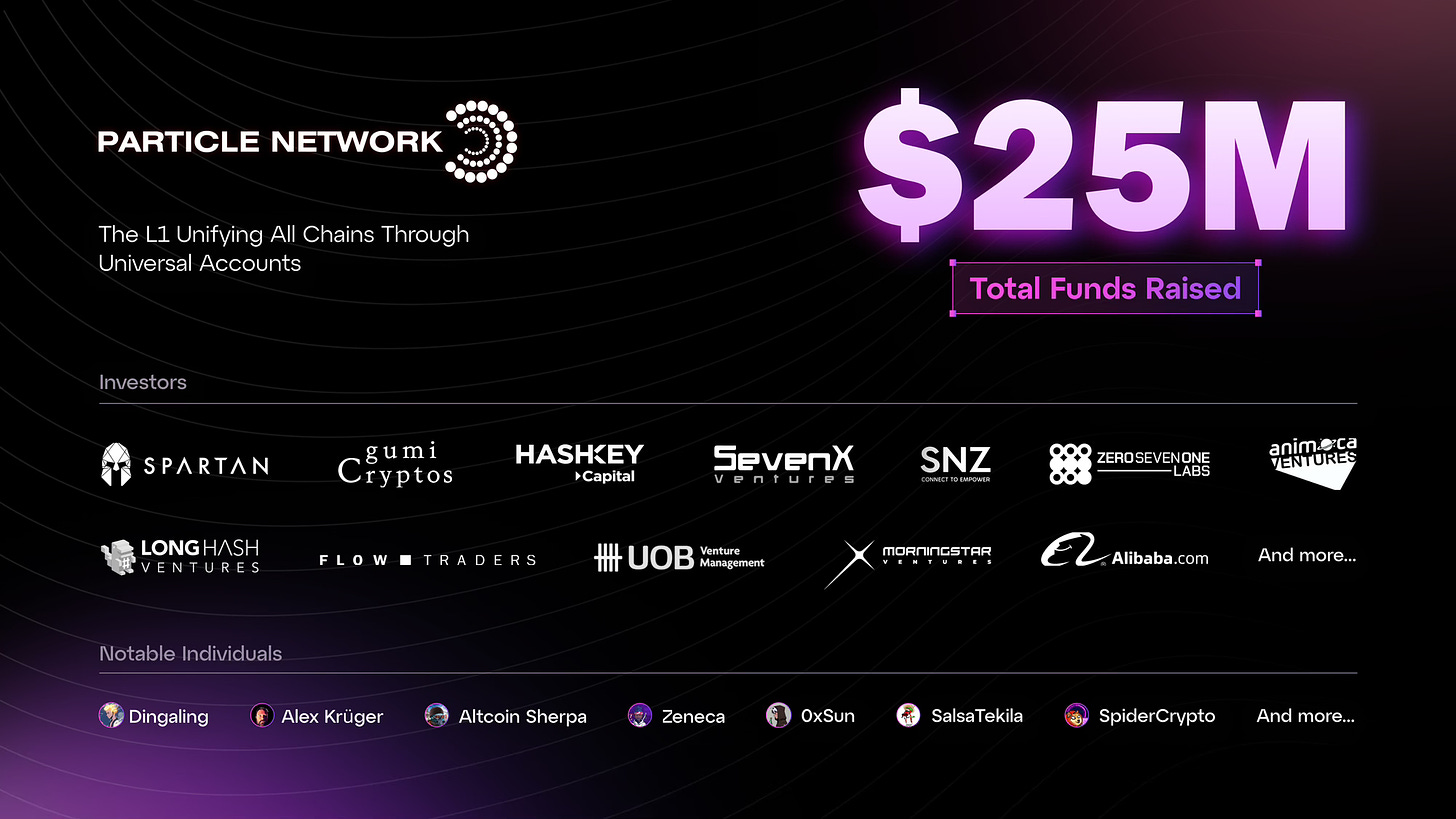

Particle Network | Infrastructure

Funding summary

Total raised: $25M

Latest round: Series A, $15M

Backers: Spartan, Hashkey Capital, Morningstar Ventures, Animoca Ventures, and more.

Quick blurb

Particle Network is a Modular Chain Abstraction Infrastructure, offering a seamless experience with “One Account, One Balance, Any Chain.”

As an L1 solution that unifies all chains through Universal Accounts, Particle Network tackles Web3’s user and liquidity fragmentation. With this system, users can maintain a single account and balance across the entire ecosystem, eliminating the need for manual bridging or asset management across multiple chains.

Early bird opportunities

The Particle Network Mainnet is set to launch in Q3 2024. In the meantime, users can test Particle’s chain abstraction features through Particle Pioneer, their testing and community program.

This Testnet has already seen extensive participation with over 114 million transactions and approximately 1.3 million Universal Accounts registered.

Website | 𝕏 | Raise announcement | CryptoRank profile

aPriori | Liquid Staking & MEV

Funding summary

Total raised: $10M

Latest round: Seed, $8M

Backers: Pantera Capital, Hashed, Arrington Capital, Consensys, OKX Ventures, Binance Labs, and more.

Quick blurb

aPriori is an MEV-powered liquidity staking platform on Monad that repurchases MEVs and redistributes the proceeds to protocols and ecosystems. It develops transaction-centric infrastructure to enhance Monad's throughput and user experience.

Early bird opportunities

The aPriori product is not yet live, and there’s no early-bird program available. However, the testnet is expected to launch soon after the latest fundraising announcement, so it’s a good idea to stay updated.

Website | 𝕏 | Raise announcement | CryptoRank profile

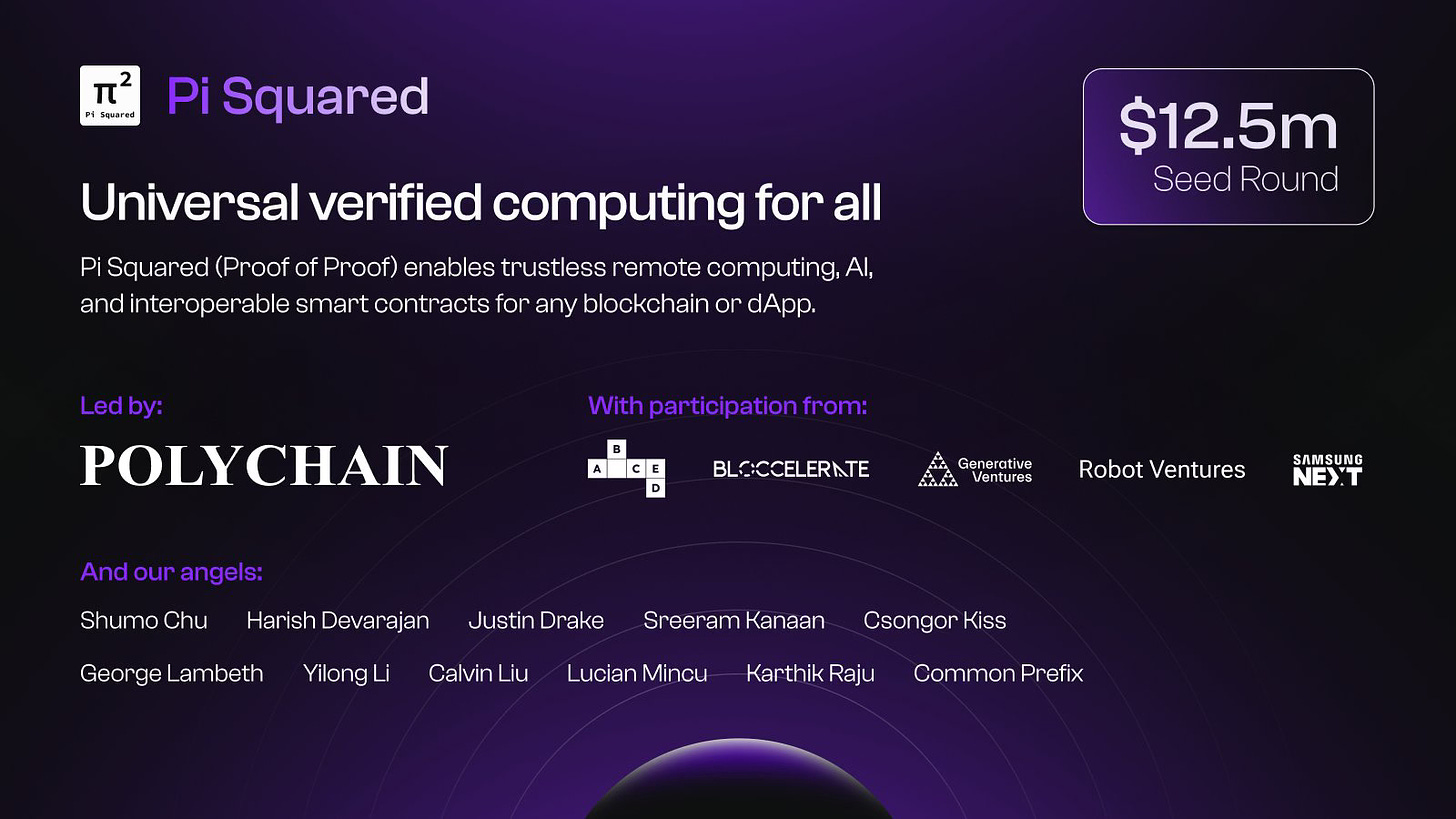

Pi Squared | Infrastructure

Funding summary

Total raised: $12.5M

Latest round: Seed, $12.5M

Backers: Polychain Capital, Robot Ventures, Samsung Next, ABCDE, and more.

Quick blurb

Pi Squared (Proof of Proof) facilitates trustless remote computing, AI, and interoperable smart contracts for any blockchain or dApp.

They are developing Pi Squared’s Universal Settlement Layer, which ensures end-to-end correctness for generic computations while adhering to typical blockchain constraints and minimizing the trust base.

This foundation supports next-gen L2s and app chains, multi-chain bridging, cross-chain DeFi, distributed computing, and more.

Early bird opportunities

Like aPriori, there’s no incentive or early-bird program currently available. However, the project has great potential and is definitely worth keeping an eye on.

Website | 𝕏 | Raise announcement | CryptoRank profile

Other protocols that deserve attention

OpenLedger | AI

$8M raised in seed funding round from Hashkey Global, Polychain Capital, and more.Mezo | BitcoinFi

$7.5M raised in a strategic round from GSR, Flow Traders, ArkStream Capital, and more.NPC Labs | NFT & RWA

$18M raised in a seed round from Pantera Capital, Hashkey Capital, Tirana Ventures, and more.Mountain Protocol | CDP

$8M raised in a Series A round from Coinbase Ventures, Multicoin Capital, Borderless Capital, and more.M^0 | RWA

$35M raised in a Series A round from Galaxy Ventures, GSR, Wintermute, and more.

How to DYOR?

For this research, I used fundraising data from Messari. However, many other tools can also help analyze fundraising data and discover new opportunities.

Here’s my list of useful tools: