Polymarket Trading Tools Masterclass: Predict → Better

Like any Web3 powerhouse, Polymarket contains vast data that can enhance trading efficiency and optimize performance. This article guides you through these essential tools.

If you’re starting on Polymarket, whether hunting an airdrop or just betting on outcomes you care about, you’ll quickly realize the platform itself doesn’t give you much data. You see a price, a chart, and a trade button. That’s it.

Meanwhile, profitable traders are using external tools to track whale wallets, spot arbitrage, analyze liquidity, and follow smart money in real-time. The gap between “just clicking buttons” and “actually knowing what you’re doing” comes down to information access.

This guide answers four questions:

What tools exist and which ones do you actually need?

How much do they cost?

What data do they show you?

How do you interpret that data to make better trades?

Tools Breakdown

If you’re airdrop farming or casual gambling

Your goal: Generate trading volume and some profit/loss without spending hours analyzing markets.

Tools you need:

(free) - Track your own performance

Why these two: PredictFolio shows you if you’re actually making money or just generating volume at a loss.

Total cost: $0

If you’re trying to make consistent profits

Your goal: Develop an actual edge through pattern recognition and smart wallet tracking.

Tools you need:

(free Standard tier) - AI analysis + arbitrage detection

(free) - Market data + top trader tracking

(free) - Track up to 15 winning wallets

Polysights gives you AI summaries of markets so you understand mispricing. Polymarket Analytics shows you who the winning traders are. Polylerts alerts you when those winners make moves.

Total cost: $0

If you’re copy-trading smart money

Your goal: Follow proven winners and execute faster than retail.

Tools you need:

(free during beta) - Real-time smart wallet alerts

Pro (~$29-99/month) - Smart Scores + insider detection

Polysights Premium ($4,000/year) - AI agents + real-time arbitrage

Polyburg tells you the second smart money moves. HashDive scores traders so you know who to follow. Polysights Premium automates execution so you’re not manually placing trades.

Total cost: $29-99/month for serious hobbyists; $4,000/year for professionals

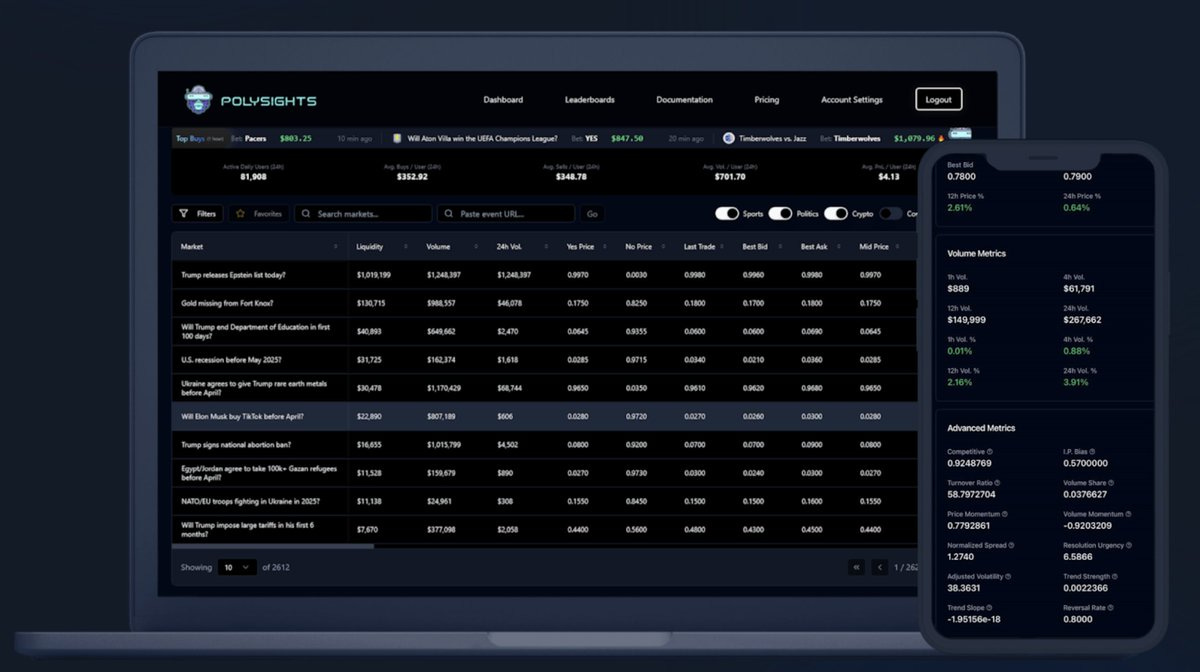

Polysights - The AI-Powered Analytics Platform

What it costs:

Basic: FREE (no account)

Standard: FREE (was paid, now free)

Premium: 1.5 ETH (~$4,000/year)

What data it shows:

Polysights shows you a big table where each row is a different market (like “Bitcoin >$100K by March” or “Trump wins election”). Each market has 34+ different data points you can see, like:

Standard metrics everyone can access:

Current price (what % the market thinks it’ll happen)

24h volume (how much money traded today)

Total liquidity (how much money is available to trade against)

Bid-ask spread (the gap between buy and sell prices)

Proprietary metrics Polysights calculates:

Market Momentum Score (is the price moving fast or slow?)

Volume Trend (is trading activity increasing or decreasing?)

Liquidity Health (is there enough depth to trade without moving the price?)

Arbitrage Score (is this market mispriced compared to other platforms?)

You can filter and sort by any of these metrics to find specific opportunities, like “show me only markets with rising volume and tight spreads.”

The platform’s standout feature is AI Market Summaries. Click any market and it generates instant analysis breaking down: Price Assessment (is this mispriced?), Liquidity (can you actually trade this?), Market Dynamics (historical patterns), and Timing (when does it resolve?).

You also get:

Order book visualization (see real bid/ask depth, not just midpoint price)

News integration via Perplexity API

Recent Trades feed (spot whale activity)

Top Positions tracking (who’s accumulating)

Arbitrage scanner (finds price gaps across platforms)

Provide a caption (optional)

How to interpret the data

Example 1 - Reading AI Summaries

Market: “Bitcoin >$100K by March” trading at 34%

AI says: “Current 34% appears undervalued based on volatility patterns. Similar markets resolved at 52%. Liquidity is $127K with 2.3% spread. Volume spikes when BTC >$95K.”

What this means: The AI thinks 34% is too low historically. There’s enough liquidity to trade without slippage. The catalyst is BTC price movement. If you believe BTC will hit $95K+, buying at 34% could be +EV.

Example 2 - Order Book Reality

Market shows price: $0.65

Order book shows:

Best sell: $0.67

Best buy: $0.64

Spread: 3%

You can’t actually buy at $0.65. You’ll pay $0.67 to get in and receive $0.64 to get out. That’s 6% round-trip cost just for execution. Your profit thesis needs to overcome this before you make money.

Example 3 - Whale Watching

Recent Trades shows: Two wallets (both 80%+ win rate) bought $50K and $30K of YES in the last 5 minutes.

What this means: Smart money is accumulating fast. Don’t blindly follow, but investigate why. Check for recent news, upcoming events, or information you’re missing. If you can’t find a reason, wait.

Who needs this: Traders who want AI to analyze markets, arbitrage hunters, anyone building a data-driven strategy.

The catch: 2-3 week learning curve. Premium only worth it if trading $10K+ monthly volume.

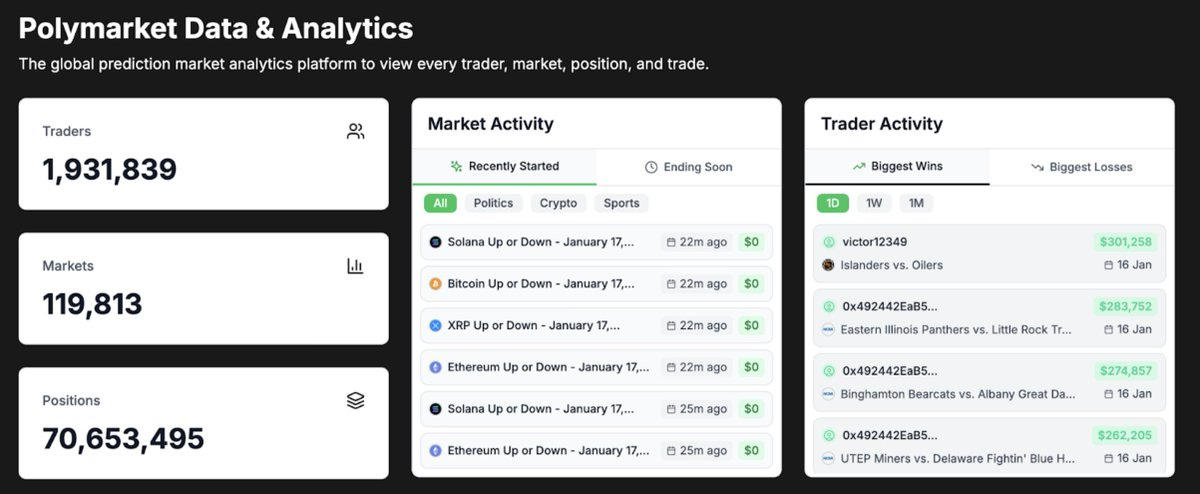

2. Polymarket Analytics: The Public Ledger of Prediction Markets

What it costs: FREE (supported by Polymarket, powered by Goldsky infrastructure)

Polymarket Analytics is the most comprehensive public database for prediction markets, tracking every trader, market, position, and trade. Data updates every 5 minutes via Goldsky’s infrastructure.📷

Core features:

Traders Dashboard

Browse and filter top traders by performance metrics, P&L history, and trading patterns. You can filter by category (Politics, Crypto, Sports) to find specialists. Each trader profile shows:

Total profit/loss over different timeframes

Win/loss history

Active positions and portfolio size

Trading volume and market specialization

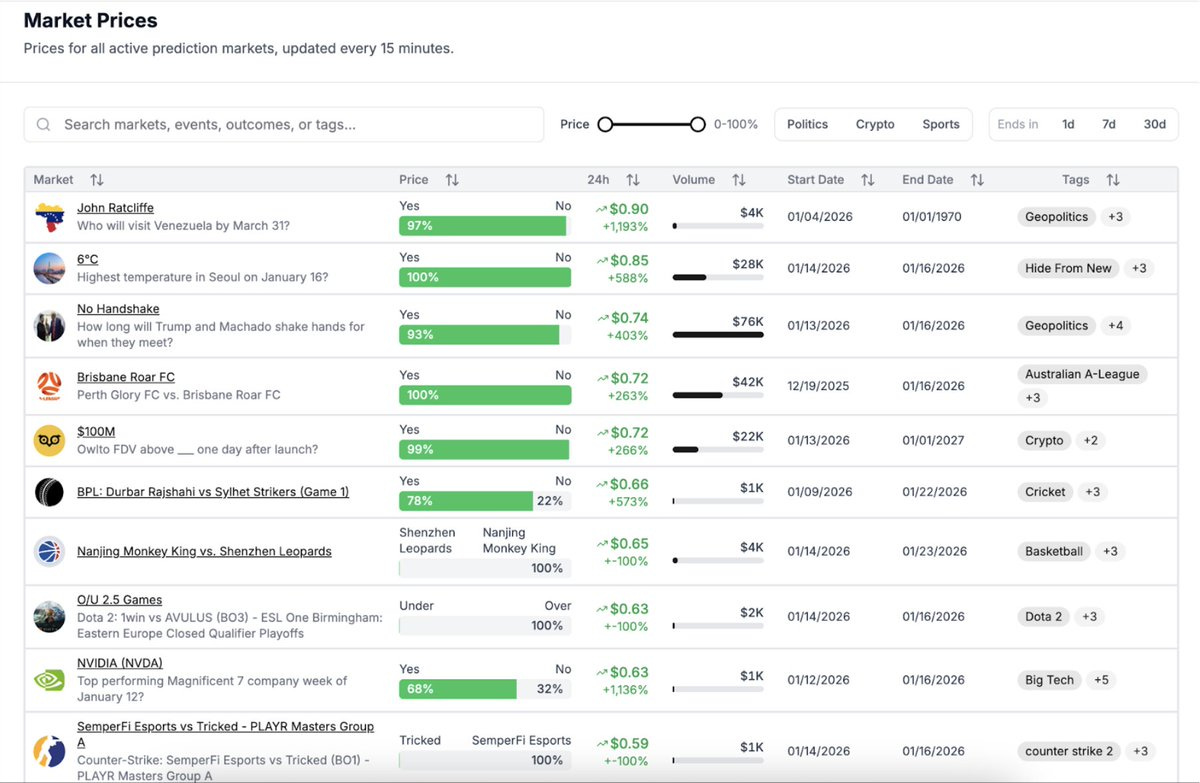

Markets Search

Search across thousands of prediction markets from both Polymarket and Kalshi in one unified view. Find specific markets, compare prices across platforms (for arbitrage), and track live price movements.

Activity Feed Real-time feed showing:

What top traders are buying and selling

Large positions being opened/closed

New markets launching

Recently started and ending-soon markets

Biggest wins and losses (1 day, 1 week, 1 month views)

Portfolio Tracker

Create custom portfolios to track multiple wallets in one place. View consolidated P&L, positions, and performance across all your accounts. Good for managing multiple strategies or wallets.

Creator Leaderboard

Track which prediction market creators are most active and successful.

Provide a caption (optional)

How to interpret the data:

Example 1 - Smart Money Discovery

Traders dashboard shows wallet ‘0x123...’ with:

Total P&L: +$847K

Win rate: 73%

Specialization: Politics markets

Recent activity: Just opened 3 new positions

This is a proven political markets specialist with serious capital. Click into their profile to see exactly what positions they just opened. If they’re betting on a specific candidate or policy outcome, that’s worth investigating.

Example 2 - Arbitrage Opportunities

Markets search shows the same event on both platforms:

Polymarket: “Event X happens” at 67%

Kalshi: Same event at 62%

Spread: 5%

Potential 3% profit after fees by buying on Kalshi and selling on Polymarket. Verify both sides have liquidity before executing.

Example 3 - Activity Feed Signals

Activity feed shows:

“Biggest Wins (1W)” - Trader made $150K on a single political market

Click through to see they bought at 35% and sold at 88%

Study how they timed the entry and exit. What news or events triggered their entry at 35%? When did they take profit at 88%? Pattern recognition for future trades.

Example 4 - Portfolio Management

You’re running three different strategies across three wallets.

Portfolio tracker shows:

Wallet A (conservative): +$2.3K

Wallet B (aggressive): -$1.8K

Wallet C (arbitrage): +$890

Combined: +$1.39K

Your conservative strategy is working, aggressive isn’t. Adjust position sizing or kill the losing strategy. Everyone trading Polymarket. It’s free, comprehensive, and shows everything happening in real-time. Use it as your base layer, then add specialized tools on top.

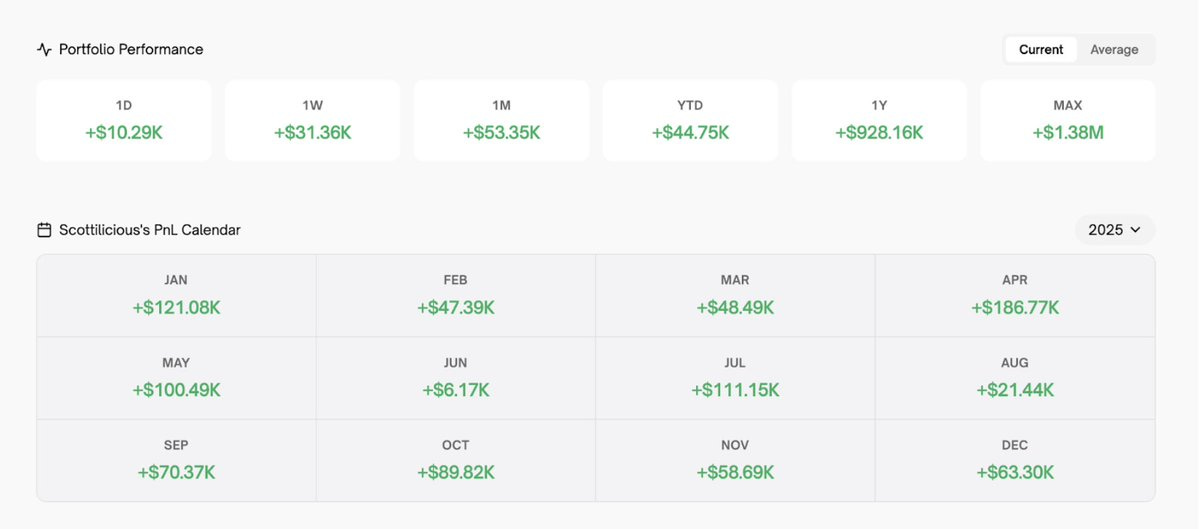

3. PredictFolio — Trader-Centric Analytics and Portfolio Benchmarking

What it costs: FREE

What data it shows:

PredictFolio tracks 1M+ Polymarket traders across 5 years of historical data and 30,000+ markets. It’s built specifically for tracking your own performance and comparing yourself against others.

The dashboard shows your live positions with current odds, complete P&L history, win rate, trading volume, and position sizing patterns. You can search millions of traders by username, wallet address, specific markets, or performance filters like P&L and win rate.

The leaderboard ranks top traders by total P&L, recent performance, win rate, and volume. Each profile includes complete trade history with entry/exit prices, best and worst trades, market category breakdown (Politics, Crypto, Sports), and performance charts over time. The performance comparison feature lets you benchmark your stats against top wallets to identify strategy gaps.

There’s also a news feed with breaking alerts related to active markets (push notifications available).

Provide a caption (optional)

How to interpret the data:

Example 1 - Learning from Winners

You search for top crypto traders and find

with a 68% win rate, averaging $2K-5K positions, entering within 2 hours of market creation, and avoiding markets with less than $10K liquidity.

Your stats show 45% win rate, $500 average positions, entering after 24+ hours, and trading any liquidity level.

Your edge isn’t position size, it’s timing and selectivity. Test entering markets faster and filtering for higher liquidity to see if your win rate improves.

Example 2 - Self-Evaluation

Your dashboard shows Month 1 at +$2,000 (10 trades, 8 wins), Month 2 at -$500 (15 trades, 7 wins), Month 3 at -$800 (20 trades, 9 wins), and Month 4 at -$200 (25 trades, 11 wins).

You’re increasing trade frequency but decreasing profitability. Your edge disappeared when you started overtrading. Go back to Month 1’s selectivity, quality over quantity.

Example 3 - Finding Your Niche

Leaderboard shows trader

with +$45K total P&L, 90%+ of trades in political markets only, 72% win rate in politics but only 40% in everything else.

Specialization creates edge. Check if you’re spreading too thin across multiple market types. Pick one category and master it.

Example 4 - Tracking Improvement

Your performance comparison shows you were in the bottom 30% three months ago, bottom 20% two months ago, bottom 15% last month, and bottom 12% this month.

You’re improving consistently. Your strategy is working, just needs more time and repetition. Don’t change course, keep executing.

Who needs this: Everyone.

Whether you’re profitable or not, you need to track performance. PredictFolio is the easiest way to see if you’re actually making money or just deluding yourself.

It’s backward-looking only. Shows you what happened, not what to trade next. Pair it with forward-looking tools like Polysights or Polymarket Analytics.

4. Hashdive: Smart Money, Insider Signals, and Trader Quality Scoring

What it costs:

Free tier available

Pro tier: pricing not publicly listed (estimated $29-99/month based on similar tools)

HashDive ranks traders by quality, not just profit. Their main feature is Smart Scores: a rating from -100 to +100 that tells you if a trader is consistently skilled or just got lucky once.

Here’s what goes into a Smart Score:

Historical profitability (did they make money repeatedly?)

Consistency over time (or did they have one lucky bet?)

Position sizing (do they bet smart amounts relative to outcomes?)

Breadth (winning across many markets, or just one?)

Other features include a market screener where you can filter by liquidity, volume, whale activity, and momentum to find good trading opportunities. There’s whale tracking showing the biggest positions and their unrealized profit/loss. Advanced price charts give you candlestick views with technical indicators like RSI and MACD. Pro users can track up to 50 wallets.

The platform also has an “Insiders” section that flags suspicious activity, like new wallets making huge bets on niche markets where they might have inside information.

Provide a caption (optional)

How to interpret the data:

Example 1 - Who to Follow

You see two traders who both made $50K:

Trader A: Smart Score +87

Trader B: Smart Score +12

Trader A made money consistently across 200+ markets. Trader B hit one lucky $50K bet but loses on most other trades. Follow A’s patterns, ignore B.

Example 2 - Spotting Insiders

A brand new wallet (zero trading history) suddenly places $50,000 on “Monad Airdrop by Oct 31.” HashDive flags this wallet with a -40 Smart Score.

This looks like insider trading. Someone with inside knowledge about the airdrop timing is betting big. The question: are they actually right, or just overconfident? Don’t blindly copy, insiders can be wrong too.

Example 3 - Whale Convergence

You check the whale tracker and see three different wallets (all with Smart Scores above +70) have bought large YES positions on the same market within 48 hours.

Multiple proven traders are betting the same way. Something is happening. Investigate the thesis before following, but this is a strong signal worth your attention.

Who needs this: Traders who want to follow smart money, people trying to separate skill from luck, those interested in detecting potential insider activity.

The catch: The Smart Score formula isn’t public, you’re trusting HashDive’s black box algorithm. Also, high scores show past performance, which doesn’t guarantee future results

5. Polyburg - Real-Time Smart Money Alerts

What it costs:

FREE during beta (invite-only)

Future: 10 alerts/day for free, unlimited for paid tier

What data it shows:

Polyburg monitors 1,200+ historically profitable wallets and alerts you instantly when they trade.

When smart wallets open/close positions, you get Telegram notifications with:

What they bought (YES/NO)

Position size

Current price

Confidence score (based on wallet’s historical win rate)

Focus is on speed, not analysis. You see who’s acting, where, and when—with emphasis on execution timing.

How to interpret the data:

Example 1 - Smart Money Signal Telegram: “Wallet 0xABC (81% win rate) bought $15K YES on ‘Bitcoin >$100K by March’ at 34%. Confidence: 8/10.”

What this means: Proven wallet took a contrarian high-conviction position. You have minutes to investigate and potentially follow before the market reacts. Don’t blindly copy—verify the thesis first.

Example 2 - Momentum Detection Three high-score wallets bought the same outcome within 10 minutes.

Smart money is converging fast, probably reacting to news you haven’t seen yet. Move quickly or wait for clarity, but something is happening.

Who needs this: Copy traders, those who want early signals before repricing.

The catch: You’re always slightly behind. By the time you get the alert, smart money already moved.

How to actually interpret data: The four rules

Rule 1: Always Check Liquidity First

Before anything else, verify the market is tradeable.

Check:

Spread <3%

Volume >$50K total

Liquidity >$10K

If any fails, skip it. Bad execution kills any edge. Market at 65% looks mispriced. But spread is 8%, volume is $4K, liquidity is $2K. Your round-trip cost is 16%. Even if you’re right, you lose on execution.

Rule 2: Whale Activity ≠ Buy Signal

Large wallets accumulating is a signal to investigate, not to blindly copy.

Look for:

Multiple proven wallets buying same outcome

Large deposits from high Smart Score wallets

New wallets making huge single bets

Example: Two 80%+ win-rate wallets bought $50K and $30K YES within minutes.

Ask WHY they’re buying. Check news, events, catalysts. If you can’t find a reason, wait. You’re missing context they have.

Rule 3: Arbitrage Needs Perfect Execution

Price gaps across platforms look free. They’re not.

Verify:

Gap >3% after fees

Both sides have liquidity

You can execute simultaneously

Withdrawal times won’t trap you

Example: “Trump wins” at 67% Polymarket, 62% Kalshi = 5% spread - 2% fees = 3% profit.

BUT if Kalshi has $5K liquidity and you’re trading $10K, you get terrible fills. If withdrawal takes 24 hours and price moves, your arb disappears.

Rule 4: Volume Spikes Always Have a Cause

300%+ volume increase in 24h means something happened.

Check:

Breaking news (Twitter, feeds)

Insider activity (wallet histories)

Discovery (Reddit/CT found it)

Technical (stop losses)

Example: Market jumps from $15K to $60K volume in 2 hours.

What to check:

News feed - anything break?

Recent Trades - new wallets or smart money?

Top Positions - did big holders exit or enter?

If news-driven, you’re late. If discovery-driven and thesis is solid, there might be edge.

What you should actually do

Week 1: Use free tools only

Sign up: PredictFolio, Polymarket Analytics, Polysights Standard

Don’t trade yet, just observe

Study top trader patterns

Week 2: Paper trade

Pick 5 markets meeting liquidity criteria

Track hypothetical trades in spreadsheet

Compare your results to reality

Week 3: Trade tiny

5-10 trades at $10-20 each

High liquidity markets only

Track everything

Week 4: Decide

Profitable? Scale to $50-100, consider paid tools

Break even? Keep grinding, study more

Losing? Stop and fix strategy

Key insight: Don’t pay for tools until you’re profitable with free ones. Don’t scale until you’ve proven an edge at a small size.

Most traders skip this and lose immediately. Don’t be like most traders.

Quick Reference: Which Tool for What?

Track your own performance → PredictFolio (free)

See all market activity → Polymarket Analytics (free)

AI analysis + arbitrage → Polysights Standard (free)

Follow smart money → Polyburg (free) + HashDive Pro ($29-99/mo)

Automate everything → Polysights Premium ($4K/year)

Just starting with $0 budget → PredictFolio + Polysights Standard

Start free. Prove profitability. Upgrade if needed. That’s the entire strategy.